Now working on a "Trader's House" Project & Documentary but more about it later.

For now let's focus on WallStreet20:

Although meritorical level of content was lower than FXCuffs (especially relating to topcis touched at Trader's House in Bielany :) )Quality speeches, projections, public companies looking for investors, brokers, they were all there. Best value as usual at this type of events were.. people.

Congratulations to organizers for gathering such high quality, creative and competent crowd. Good luck next year. You're likely to see me there again.

The views.. Wasn't complaining..

.kemoT xht giB

Plenty of sharks attended.

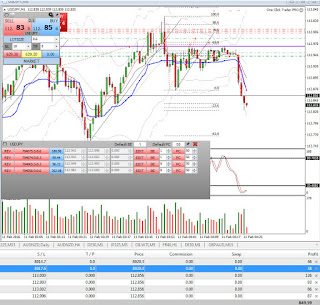

Minding some business with HFT Brokers.

Foosball world champions. Wasn't easy but managed top pull one of the higher-scores. :p

CCC, TAURON, ZORTRAX. GL and watch out for those growing polish companies.

ZORTRAX, 3D printing company you will here more about soon..

Pawel Cymcyk's presentation on BREXIT. One of better presentations I've attended. Well done sir.

Golebiewski Hotel Complex in Karpacz, Southern Poland: